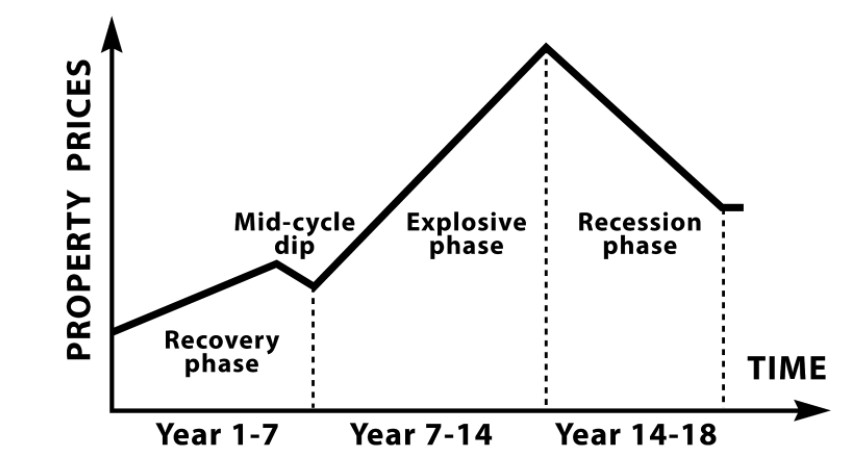

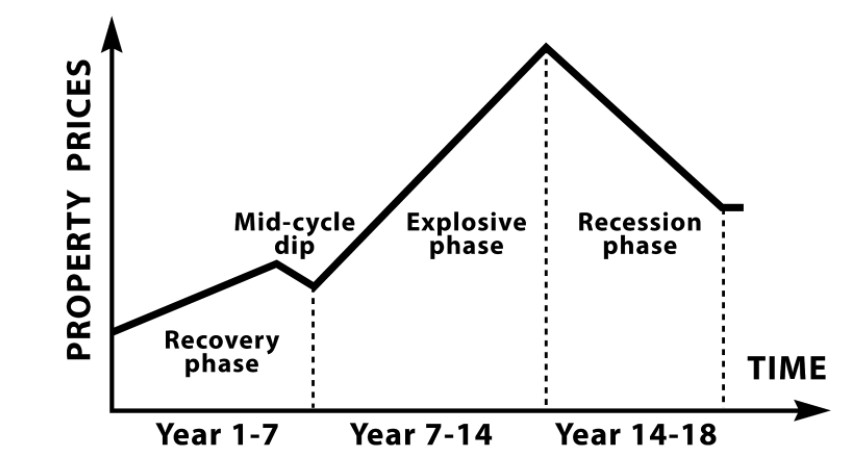

The real estate industry is known for being cyclical, with periods of boom and bust that can have a profound impact on the economy. One such cycle that has been observed and studied extensively is the 18.6-year Real Estate Cycle, also known as the Land Cycle or Property Cycel. This cycle is based on the observation that major peaks and troughs in the real estate market tend to occur roughly every 18 to 19 years. Understanding this cycle is crucial for investors, developers, and policymakers alike, as it can provide valuable insights into the direction of the market and help inform investment decisions.

Why is there a real estate cycle, and why does it repeat?

There are several factors that contribute to the real estate cycle, including economic, demographic, and policy-related factors. Economic factors, such as interest rates, inflation, and employment levels, can have a significant impact on the demand for housing and the overall health of the real estate market. Demographic factors, such as population growth, migration patterns, and changes in household composition, can also influence the demand for housing and the types of properties that are in demand. Finally, policy-related factors, such as zoning regulations, tax policies, and government incentives, can affect the supply and demand of housing and the overall health of the real estate market.

The real estate cycle is thought to repeat because of the interplay between supply and demand. During periods of economic growth and demographic expansion, demand for housing tends to increase, leading to a rise in prices and an increase in construction activity. However, as supply catches up to demand, prices begin to level off, and construction activity slows down. This eventually leads to an oversupply of housing, which, in turn, leads to a decline in prices and a decrease in construction activity. As prices bottom out and the oversupply is absorbed, the cycle starts anew with a period of economic growth and demographic expansion.

Stages of the Real Estate Cycle

The real estate cycle is typically divided into stages or phases: recovery, expansion, hyper-supply, and recession. Understanding these stages is crucial for investors and developers, as it can help inform investment decisions and risk management strategies.

1. Recovery Phase: This stage occurs immediately after a market downturn and is characterized by low prices and low levels of construction activity. Property prices have fallen enough to tempt investors to begin buying again, attracted by the high yields that are available from low home prices while rents remains healthy(rents remain strong because people always need a place to live). During this stage, investors and developers may begin to see opportunities to acquire properties at discounted prices, with the expectation of future price appreciation.

2. Expansion Phase: As the market recovers, demand for housing begins to increase, leading to rising prices and an increase in construction activity. During this stage, developers may begin to invest in new construction projects, with the expectation of future profits. Large companies and pension funds start buying up distressed portfolios. The prime assets will always be the most attractive, so this early growth tends to begin in the most popular real estate markets and expand from there.

3. Hyper-supply Phase: At some point, the increase in construction activity leads to an oversupply of housing, which can cause prices to level off or decline. During this stage, developers may face increased competition and a decrease in profitability, while investors may begin to look for opportunities to exit their positions. As the early movers take their profits there may be a slight mid-cycle dip.

4. Recession Phase: Eventually, the oversupply is absorbed, and the market begins to stabilize. However, if economic conditions deteriorate, it can lead to a recession, which can cause prices to decline sharply and lead to a decrease in construction activity. During this stage, investors and developers may face significant losses, and those who are over-leveraged may be forced to sell at a loss. Economist and author Fred Harrison used the term “winner’s curse” in his book “Boom Bust” to describe buyers that “won” by placing the highest bid for a property with multiple offers during this phase because the next recession isn’t far away, and it won’t be long before the asset they just purchased will be worth markedly less.

Previous real estate cycles in the United States

The United States has experienced several real estate cycles throughout its history, with some of the most notable cycles occurring in the 1920s, 1970s, and 2000s.

1. The 1920s: The 1920s saw a period of economic growth and demographic expansion, with the rise of the automobile and the growth of the middle class leading to an increase in demand for housing. This led to a period of expansion in the real estate market, with construction activity increasing and prices rising. However, this period of growth was not sustainable, and the market eventually experienced a major downturn in the late 1920s, which was exacerbated by the stock market crash of 1929. This led to a period of hyper-supply, with an oversupply of housing and a decrease in construction activity. The real estate market did not fully recover until after World War II.

2. The 1970s: The 1970s were marked by significant economic and demographic changes, including the oil crisis, inflation, and the rise of the baby boomer generation. These factors had a major impact on the real estate market, leading to a period of expansion in the early 1970s, followed by a period of hyper-supply in the mid to late 1970s. During this period, interest rates rose sharply, which led to a decline in demand for housing and a decrease in construction activity. The market did not fully recover until the early 1980s.

3. The 2000s: The 2000s saw a period of economic growth and demographic expansion, with the rise of the internet and the growth of the service sector leading to an increase in demand for housing. This led to a period of expansion in the early to mid-2000s, with construction activity increasing and prices rising rapidly. However, this period of growth was not sustainable, and the market eventually experienced a major downturn in the late 2000s, which was triggered by the subprime mortgage crisis. This led to a period of hyper-supply, with an oversupply of housing and a decrease in construction activity. The real estate market did not fully recover until several years later.

4. The real estate crash that occurred from 2006 to 2012, commonly referred to as the Great Recession, was one of the most significant downturns in the history of the U.S. real estate market. The crisis was triggered by a combination of factors, including loose lending standards, a housing bubble, and the proliferation of complex financial instruments that were poorly understood by investors and regulators alike.

Leading up to the crisis, housing prices had risen rapidly throughout the early 2000s, fueled by low interest rates, lax lending standards, and a speculative frenzy among investors. Many homeowners took on mortgages they could not afford, relying on the assumption that housing prices would continue to rise indefinitely. However, in 2006, the housing market began to cool off, and prices began to decline. This led to a wave of defaults and foreclosures, as homeowners found themselves unable to keep up with their mortgage payments.

At the same time, a variety of complex financial instruments had emerged that were tied to the value of housing, including mortgage-backed securities and collateralized debt obligations. These instruments were sold to investors around the world, who assumed that the underlying mortgages were sound and that the value of the securities would continue to rise. However, as the housing market began to collapse, the value of these securities plummeted, causing widespread losses and a crisis of confidence in the financial system.

The fallout from the Great Recession was severe, with millions of Americans losing their homes, and the U.S. economy entering a deep recession that lasted for several years. The crisis also had a significant impact on the real estate market, with housing prices falling by as much as 30% or more in some areas, and construction activity grinding to a halt. It took several years for the market to recover, with the government implementing a variety of policies and stimulus measures to help stabilize the economy and support the housing market.

The Great Recession serves as a stark reminder of the dangers of speculative bubbles and the importance of responsible lending practices. While the real estate market has since recovered, the scars of the crisis continue to be felt by many Americans, and the lessons learned from the experience will undoubtedly shape the way we think about real estate investing and financial regulation for many years to come.

In each of these cycles, home prices experienced significant changes. For example, during the 1920s cycle, home prices increased by roughly 60% between 1920 and 1929, before declining by roughly 30% between 1929 and 1933. Similarly, during the 2000s cycle, home prices increased by roughly 90% between 2000 and 2006, before declining by roughly 30% between 2006 and 2012.

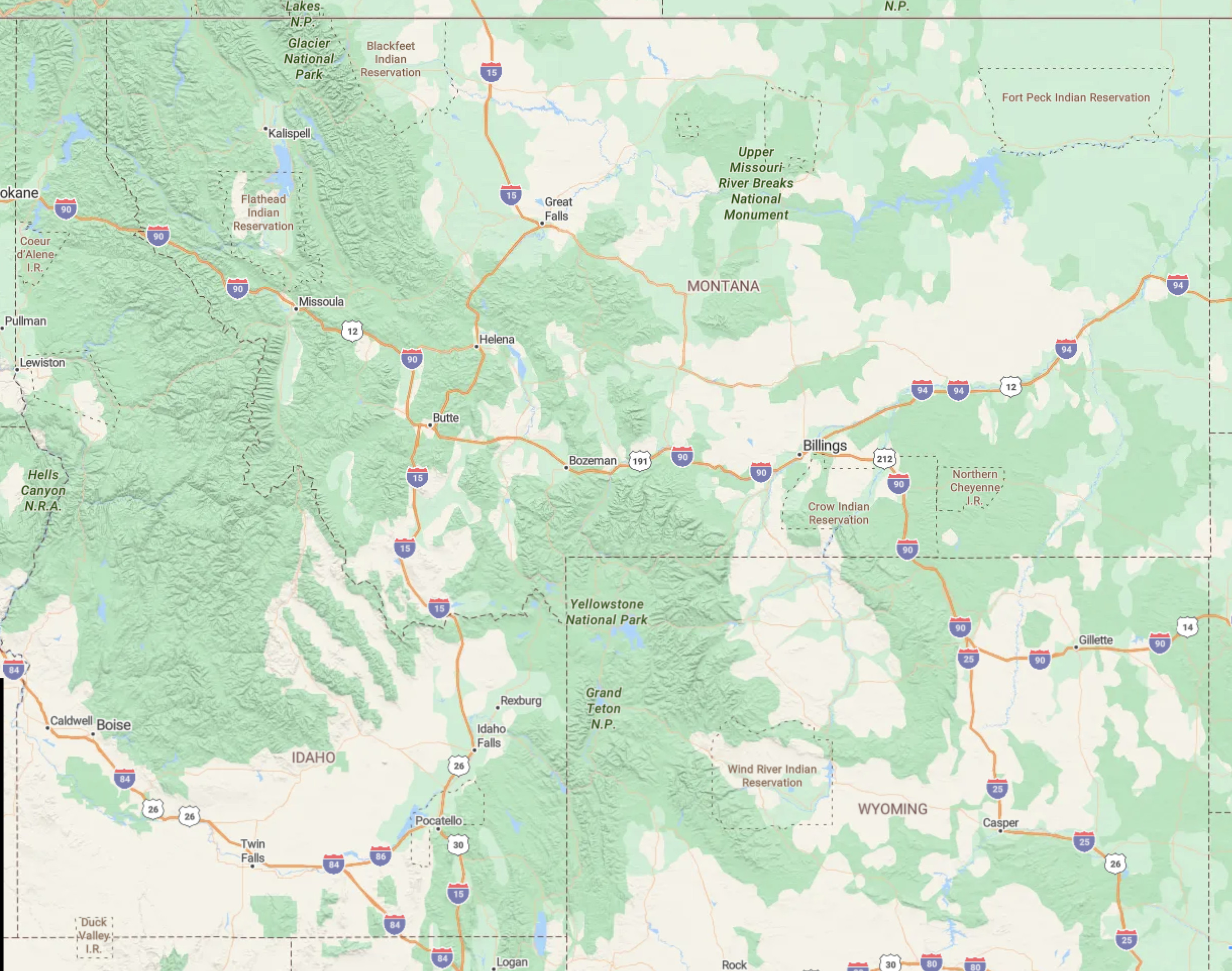

Bozeman Real Estate Cycle

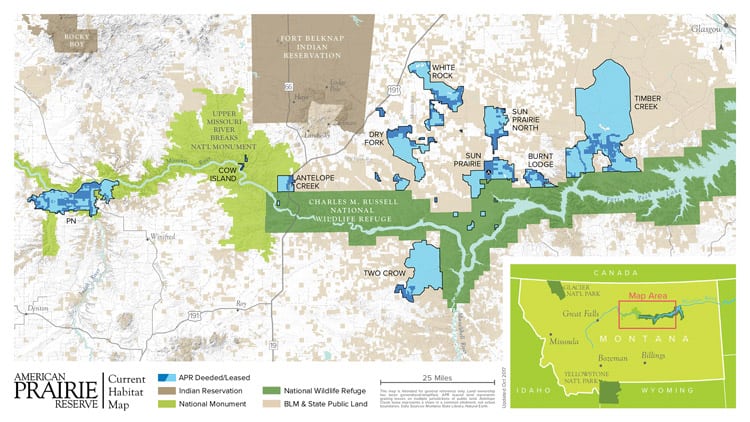

Bozeman, Montana, like many other regions, experiences a real estate cycle characterized by periods of growth and decline. Bozeman has experienced steady population growth in recent years, leading to increased demand for housing and a rise in real estate prices. The Bozeman area is known for its natural beauty, outdoor recreational opportunities, and a vibrant economy anchored by Montana State University.

The most recent Bozeman Real Estate Cycle began around 2010, following the Great Recession, with prices gradually recovering and then surging in the mid-2010s. By 2018, the market had become extremely competitive, with many buyers struggling to find affordable housing. However, by 2020, the market had begun to cool off, with prices stabilizing and demand decreasing somewhat.

Conclusion

The 18.6-year Real Estate Cycle, also known as the Land Cycle or Property Cycle, is a well-documented phenomenon that has been observed throughout history. While the causes of the cycle are complex and multifaceted, the interplay between supply and demand is a key driver. By understanding the stages of the cycle and the factors that contribute to it, investors, developers, and policymakers can make informed decisions and better manage risk. While past performance is not indicative of future results, studying the previous cycles can provide valuable insights into the direction of the real estate market and help inform investment decisions.