REAL ESTATE INVESTING

Delger Real Estate maximizes return on investment through strategic guidance and comprehensive support after the purchase.

Delger Real Estate assists real estate investors by providing expert market analysis, identifying lucrative investment opportunities, and negotiating favorable deals. Delger Real Estate leverages their extensive knowledge of local market trends and property values, helping investors make informed decisions and avoid potential pitfalls. Additionally, they offer access to exclusive listings and a network of industry contacts, facilitating smooth transactions and profitable management of investment real estate.

Real Estate Investing Is About Acreation And Time

Will a single family home pay for itself from the rent it generates?

Will a piece of farm land pay for itself from the crop grown on it?

In both questions, it is a rare case if you have to finance more than 50% of the purchase price and mortgage rates are above 7%. However, over time it is expected that the revenue generated from crops will increase. It is also expected that over time, the revenue generated from rent will increase.

When a farmer adds additional acres of crop land to their operation they are depending on cash flow from existing acres to pay for the new acres. The same principal applies to purchasing additional single family home rentals. The investor is depending on cash flow from existing rental properties to pay for the new rental property.

Over time, additional investment property may be acquired from the profits generated from existing properties.

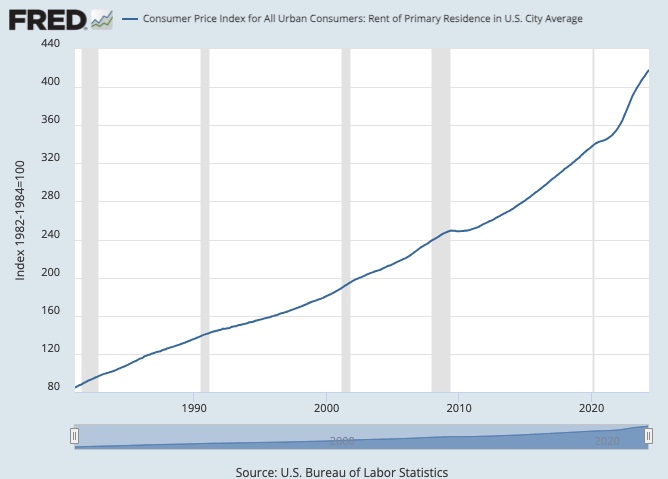

Historically, rent prices for a primary residence increase. Over the last 10 years(Q1 2014 to Q1 2024) the average cost of rent in the United States has increased 4.23% per year.

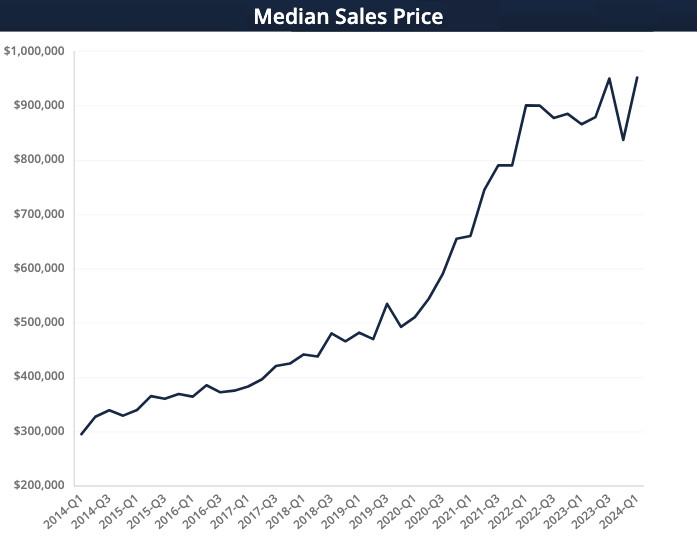

Historically, good investment properties also increase in value(appreciation). Over the last 10 years(Q1 2014 to Q1 2024) the Median Purchase Price of Single Family Homes in Bozeman has increased 11.51% per year.

Bozeman Investment Real Estate

When evaluating investment real estate, investors often consider both current income potential and the potential for property appreciation. Here are the key factors involved:

Cash Flow: This is the net income from the property after all operating expenses and mortgage payments have been made. Positive cash flow properties generate income for the investor on a regular basis.

Appreciation: This refers to the increase in the property’s value over time. While it’s more speculative, appreciation can significantly enhance the return on investment if the property is sold at a higher price in the future.

Tax Benefits: Investors can benefit from tax deductions related to depreciation, mortgage interest, and other property-related expenses.

Leverage: Real estate investments often involve borrowing, which can amplify both gains and losses. Leveraging allows investors to control larger assets with a smaller initial investment.

Market Conditions: Economic indicators, local market trends, and property location play crucial roles in both current cash flow and potential appreciation. Understanding the market is essential for making informed predictions about future property values.

Risk Management: Diversification, thorough market research, and contingency planning are important to mitigate risks associated with real estate investments.

While cash flow provides immediate income, appreciation can lead to significant long-term gains. Both factors should be considered in conjunction with one another to determine if an investment is a good opportunity

There are several common calculations for analysing investment real estate: IRR, ROI, Cap Rate, GRM, GRY, and Cash On Cash.

One of the simplest investment real estate calculations is Gross Rental Yeild. Gross Rental Yield (GRY) is a measure of the return on investment for an investment property, based on the rental income generated by the property. It is calculated as follows:

GRY = (Annual rental income / Purchase price) x 100%

Gross Rental Yield removes variables like debt payments, taxes, insurance, management and maintenance costs from the analysis.

A good Gross Rental Yield varies depending on various factors such as location, type of property, local market conditions, and individual investor goals. Generally, a GRY of 5% – 8% is considered a good yield for developed markets, while emerging markets may have higher yields in the range of 8% – 12%.

Gross Rental Yields in Bozeman, Montana tend to be around 5% to 7%. Example: A home in Bozeman that is purchased for $800,000 may expect to generate $3,400 per month in income. This is GRY of 5.10%.

Interest rates on mortgages play a significant factor on what it will take to get a property to generate positive cash flow. Investment Real Estate typically involves a non-owner occupied mortgage. Non owner occupied mortgage interest rates average about 1% higher than an owner occupied mortgage for a primary home.

In our experience an investor will need to pay at least 40% cash for a property (financing the remaining 60%) when a non owner occupied mortgage rate can be obtained for less than 4%. (*not including management and maintenance costs)

When non owner occupied mortgage rates are above 8%, the investor will need to pay 60% or more in cash to get an investment property to cash flow. (*not including management and maintenance costs)

Here are a few “Back Of The Napkin Calculations” involving different mortgage rates, and down payments on a $800,000 single family rental property generating $3,400 per month in rent.

3.625% Mortgage Rate

Purchase Price: $800,000

Down Payment: $320,000 (40%)

Mortgage Payment: $2,782/mo (30 year fixed)

Rent Income: $3,400/mo

8.2% Mortgage Rate

Purchase Price: $800,000

Down Payment: $480,000 (60%)

Mortgage Payment: $2,986/mo (30 year fixed)

Rent Income: $3,400/mo

Delger Real Estate owns and manages a portfolio of investment real estate in Bozeman, Montana. Partnering with Delger Real Estate ensures that you receive unparalleled market insights and access to exclusive investment opportunities. Our seasoned brokers excel in identifying high-yield properties and negotiating optimal deals, maximizing your return on investment with strategic, data-driven guidance every step of the way.